Summary

This article is a case study for how associations can get into game-based learning. We lay out the steps to design and achieve an ideal state outcome, leverage an existing brand and/or content, develop a new revenue source, create impact, and position gaming as a prominent identity driver.

Learning how to build game-based learning as a durable, engaging association product is one thing you can do in the product community. View our explainer video to see how the product community works:

Creating a durable system of play

Here are ten recommendations to anchor strategy, productize learning, and guide action:

Leverage strengths. Associations have underutilized content, energetic and experienced staff, and best-in-field subject matter experts that can help us move from a culture of one-offs into a durable, sustainable gaming culture.

Find a proven, but agile partner. Associations can work with a partner who balances our in-house experience of working with volunteers and creating learning with the agility of building games over the long haul.

Build a product roadmap. Associations can build games on a product framework. This can be a key differentiator. The product framework requires a roadmap led by a product lead who manages product development, evolution, and success by building an ideal state outcome (ISO), versioning path, go to market strategy, and an outcomes assessment plan.

Build something that’s recognizable. Games should be as intuitive and easy to play as they are interesting and engaging. They also need to be widely available and accessible. One other thing: they may not need to be expensive to build!

Focus on intrinsic motivations. Though it may be important to accredit games for extrinsic motivation, it is more important to build something that is fun, sticky, and draws broad communities of learners.

Create the market. There is a struggle to confidently identify the market, so there is an opportunity to build games that have no current market competition in topic areas of wide interest to our core market using mature distribution channels.

Leverage a subscription model. Though there are multiple ways to monetize games, a subscription model is recommended for market entry. In the short run, it is the cleanest way for learners to ‘pay for play’. Gaming as a Service (GaaS) holds promise as an approach that combines distribution and subscription services.

Build games that have multiple scale paths. Associations can develop games that have multiple scale paths built into the product roadmap and game design. This will enhance the game experience as associations can build games with optimal distinctiveness designed to spin off successful concepts to new markets, deeper treatments, or additional delivery modalities to widen reach.

Invest to win. The success of a game-based learning is linked to developing a diversified revenue path that results in growth and impact. This cannot happen unless resources are allocated for product development, impact measures, and a go to market strategy.

Triangulate the funding plan. Until the ideal destination of self-funding game-based learning, we recommend a diversified funding plan to get the program started and to create a longitudinal product roadmap in which game creation, spin-offs, consumption patterns can all be predicted and planned.

Why game based-learning?

The charge for game-based learning can come from a larger investment in learning that links shared direction to broad-based growth. Ultimately, game-based learning is about connection. The business case derives from an ambitious learning strategy built on three powerful anchors:

Personalized Learning – Stresses choice-driven and adaptive learning that combines defined pathways and social interaction.

Product-Centrism – Combines our ability to understand and respond to learners with agile product development processes and the ability to execute on demand.

Learning Communities – Provides learners immediate, longitudinal, and engaging communities to maximize their connection to their association over the length of their career.

Together, a learning strategy and ambition to scale present an opportunity to create a differentiator: developing a learning model as that is naturally experiential, applied, and challenging.

Game-based learning provides an unprecedented opportunity for associations to scale community and to motivate learners to engage durably over time. It also provides an opportunity to acquire new learners and to retain learners currently in one’s chosen core market.

At its simplest, game-based learning is just another modality. At its most robust, game-based learning holds potential to identify and exploit new vehicles of engagement, build longitudinal relationships, and identify patterns of learner-player behaviors, preferences, and connections.

Gaming can also enhance an association’s reputation as an innovator and leverage our content in ways that both structure and enhance the learning journey.

Secondly, the world is changing rapidly and we must evolve as our members will encounter different and evolving professional contexts throughout their careers. We must continue to advance as technology challenges how a digital generation of learners navigate a hyperconnected world.

Third, our learners are changing. In a digital world, learners are different from previous generations. Though they are digital-first learners, they still regard in-person social interaction and community as important.

Associations should respond to the changing nature of learners by utilizing more team-based, collaborative, and game-based learning rather than insisting on only traditional teaching methods.

Finally, there is ample evidence that gaming works.

Serious games have proven to be an excellent medium to explain and teach complex concepts through experiential learning and a wide variety of domains.

Moreover, simulation games are commonly used to allow learners to experience situations that would otherwise be too costly, hazardous, or unethical to experience in the real world.

Simulation games are useful to understand complex problems through experiential learning. They also allow for making mistakes in a safe environment and learning by trial and error.

How can we build off our creative strengths in order to enhance our value proposition, deepen engagement, and significantly widen both our market share and influence?

What is game-based learning?

Gaming is a delivery modality that emphasizes learning through engagement, fun, challenges, and hands-on activities.

We can purposefully define gaming broadly. We include simulation, augmented, digital, in-person, and virtual reality as possible delivery modalities to design and enhance learning in order to improve practice and patient outcomes.

Game-based learning has defined learning outcomes and is designed to balance subject matter with play and the ability of the player to retain and apply learning to the real world.

All games share three fundamental characteristics: they have a clearly defined set of rules; a rapid feedback system; and a well-established goal. Among the many elements that games consist of, three are, in particular, relevant to education (see below graphic):

Mechanical elements, such as incremental progression, onboarding, and instant feedback;

Personal elements, such as status and visibility, collective responsibility, and leaderboards or rankings; and

Emotional elements, in particular the psychological state of flow.

As one can surmise from the graphic, game development is an interdisciplinary concept that embraces art, design, software engineering, psychology, strategy, and business.

This implies that game-based learning is an association-wide commitment. Through feedback and data analysis, we have learned that learners desire a mobile experience, bite-sized content, and short timespan games; roughly half of players prefer game-based learning to a traditional lecture.

We also know that learners want us to meet them when and where they want to learn. From a development perspective, most current games are case-based with faculty-generated content and assessed by multiple choice questions.

Despite documented successes, there are developmental, technical, and delivery barriers that prevent us from reaching and impacting more learners.

Games are not widely available, hard to access, and lengthier game-times limit engagement, repetition, and return plays.

An embrace of gaming reflects a value for play, tolerance for risk-taking, and zeal for innovative, hands-on learning. It is this culture of innovation upon which future gaming will be built.

We can lay the foundation and provide an opportunity for game-based learning to be a strategic growth driver. This ideal state describes a world in which gaming becomes a differentiator:

We build and deliver agile games that are fun, engaging, and social. Game-based learning is immersive, available, and ubiquitous. Games are a high-growth and high-impact vehicle that draws people to our association for equally exciting and serious learning that has a direct impact on performance and outcomes.

The game-based learning ISO represents an evolutionary shift that requires successful implementation. This will require a partner, staffing, a funding plan, and a change in thinking.

As this article demonstrates, it also requires an evolution in product-development that embraces a resourced and agile product roadmap, tracking of robust growth (in learners and revenue), and the measurement of program success and learning outcomes.

As will soon be demonstrated, there are some risks in executing an ambitious game-based learning strategy. Our business case, therefore, lays our multiple avenues for scale and monetization as well as our need for a dedicated partner(s) to develop games that are exciting, accessible, and leverageable.

Gaming as Association Identity Driver

Our continued investment in gaming will serve as a powerful identity driver. We will do this by integrating game-based learning across the association experience. Gaming thereby transcends a single product line; it will be a brand-driver and, by design, be embedded throughout our product portfolio. Four pillars extend this concept.

Gaming touches all experiences

Gaming demonstrably improves member’s lives

Gaming drives innovative learning

Gaming differentiates and amplifies the association

To achieve optimal distinctiveness, game-based learning should showcase deeply held values while serving as a muscular vehicle for amplifying an association’s learning strategy.

This is synthesized in the following value proposition: games exist to significantly enhance and improve learning through engagement, collaboration, challenges, competition, or knowledge transfer. All games are part of an ecosystem that fosters:

Longitudinal experiences – 50-year journey

Maximized player journeys – stickiness and impact

Agile and derivative development – immersive growth engine

This value proposition celebrates a model of gaming that moves far beyond ‘gaming as product’.

In fact, in building a robust longitudinal engagement model, we extend the concept of gaming playing experience towards a force for learning and scale across the lifecycle.

Engagement means connection and connection means growth.

Like all learning, an association’s moonshot is demonstrably linking game-based learning to enhanced member outcomes.

A Sample Business Model

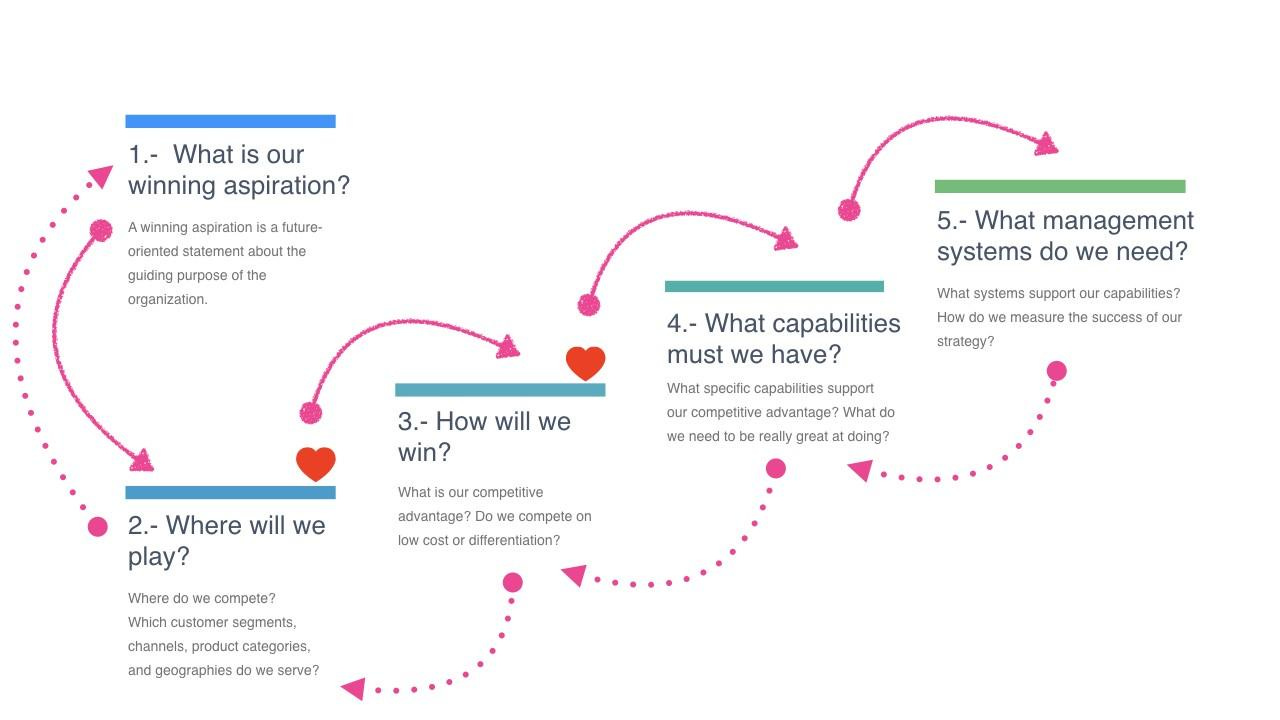

The business objective for game-based learning can be to scale our community and extend our reach throughout the member experience. This section explains the game-based learning business model through five questions. Responses to these questions make up the strategy canvas that comes from the book Playing to Win: How Strategy Really Works by Roger Martin and AG Lafley.

Though all sections of the strategy canvas are important, the heart of any strategy is where we will play and how we will win. To adopt ‘games as a service’ and an ‘online gaming ecosystem’ across multiple market verticals that leverage adult learning practices to trigger connection, enhance learning, and foster longitudinal engagement.

Using the canvas as a guide, here is a synthesis of game-based learning strategy.

What is our winning aspiration? Our association will be uniquely positioned as a leader in immersive learning to deepen connection, extend engagement, and foster exciting community momentum.

Where will we play?

Where do we compete? In the areas of an association’s core membership. Over time, we widen the market.

What customer segments? We recommend identifying broad customer segments within the core membership and building outward from there (to widen the number of learners within the core market and to widen the number of learners from tangent or new markets).

What delivery channels? We have identified seven delivery channels. We will start with the first four channels – gaming ecosystem, digital distribution, conference experience, product embeddedness – and expand to the other three over time.

What product categories? Game-based learning focused on problem solving member problems and delivered through multiple immersive modalities.

What geographies? US markets.

How will we win? Our competitive advantage can be triangulated:

Brand equity, unique content, subject matter experts, supportive learner journeys, and strategic focus.

First to market - We move fast, develop games on an agile product framework, and build games that fulfill a market need.

Differentiation - Games are recognizable yet differentiated. We can lead the field as we demonstrate optimal distinctiveness: games elegantly designed that do not exist in the market and are built for the niche yet robust area of an association’s core purpose.

What capabilities must we have?

What specific capabilities support our competitive advantage? Game development that supports the competitive advantage. The association can lead strategy execution, build the product roadmap, and govern the day-to-day management of the program. Associations can work with a partner to build and help distribute the games.

What do we need to be really great at doing? Agile product development, learning pathways, managing market growth, and data collection and analysis that demonstrates impact.

What management systems must we have?

What systems support our capabilities? We will adopt an ecosystem approach to game development and delivery. This includes internally deployed technologies such as a gamified social LMS, CRM for managing sales flows, leveraging data patterns, and an enhanced ability to buy. We will also need to build strong bridges to external technologies. See distribution channels.

How do we measure the success of our strategy? The product roadmap will have an embedded metrics plan that will provide an in-depth and ongoing picture of the game-based learning program.

Games as a service (GaaS) offers games or game content on a continuing revenue model, similar to software as a service. GaaS provides ways to monetize video games either after their initial sale or to support a free-to-play model.

Games released under a GaaS model typically receive a long or indefinite stream of monetized new content over time to encourage players to continue paying to support the game. This often leads to games that work under a GaaS model to be called "living games,” since they continually change with these updates.

The principal reason to adopt GaaS is financial, providing an opportunity to capture more revenue from the market than with a single release title (known as "games as a product"). While not all players will be willing to spend additional money for new content, there can be enough demand from a smaller population of players to support the service model.

Our aim is to think differently about how we develop and deploy games. We want to invest up front, create a robust product roadmap, and aggressively reach and grow new markets.

Distribution channels. Our games will be developed and delivered as GaaS through the following delivery channels.

Channel #1. Gaming ecosystem. An association can adopt a gamified, social platform as its next learning management system. This way, all learning – not just games – can be gamified to harness tangible motivation through embedded pathways, integrated assessment, and measurable outcomes that demonstrate impact. All courses could have points assigned to them and sections can be unlocked or provide opportunities based on performance.

Channel #2. Digital distribution. Digital distribution is the dominant method of delivering games on mobile platforms. Lower barriers to entry allow developers to create and distribute games on these platforms, with the mobile gaming industry growing considerably as a result. The most prominent platforms are iOS, Android available through Amazon Appstore, Google Play, iTunes, Samsung Galaxy Apps, or Steam. AR and VR games are distributed through Google Play, iOS app store, HTC Vive, or the Oculus Store. The positives to distributing games through these channels are the significant reach and ease of reaching learners.

Channel #3. Conference experience. This is our prevailing distribution model in which we build games funded by grants or industry for delivery each fall at the annual conference. We can, however, shift the experience in two key ways: (1) to think of annual conference as a big splash release party in which we incubate big ideas garnering a spike in usage and subscription sales and (2) we use annual conference to push hard on getting learners engaged in gaming pathways that are longitudinal in nature and last far beyond annual conference.

Channel #4. Product embeddedness. Games can be designed to integrate into an increasingly interdependent product portfolio inside or outside the gamified LMS (see Channel #1). This will, in turn, gain us access to new players, hook them on a learning pathway, and continue to build their connection. Integrating ‘games for the duration’ will also offer the opportunity to charge a premium.

Channel #5. Partnership pathway. Games can be designed for forging new ventures, relationships and new market creation. How can we build an ecosystem that other organizations might utilize? How might we tap and build new markets by integrating our games into generalist markets, advocacy groups, other societies, schools, or universities? We need a partnership rubric linked to a deep dive market analysis in order to be strategic about a partnership pathway rollout.

Channel #6. Consulting model. Over time, we can seriously consider how a knowledge distribution network might resemble a consulting model. This way, we could provide guidance on how to build games, a gaming ecosystem, and authentic assessment models that result in demonstrable impact. This will not be an early distribution model, but something that emerges over time. However, we need to add it to the blue-sky product roadmap from the beginning. Brand equity. It’s not only what we do well, it’s how we do it and how we measure it for impact. As a gaming ecosystem matures, other associations will want our guidance.

Channel #7. Licensing. How might we extend our influence and reach through a licensing distribution model? As licensor, we would provide access to our games for a fee and also collect royalties. This would require us to own the IP and underlying code outright. A sound channel strategy will clearly address market demand, market segmentation, but also how much it will cost us as the undetermined target audience for each segment may be different. Like the consulting model, this is not a short-term proposition but something that can be grown into.

Building Games on a Product Framework

It’s important to frame game-based learning as part of a commitment to product-centrism. Product-centrism is the ability to respond flexibly to coming market forces and understand our learners deeply in order to anticipate and meet their wants and needs.

See the below figure for a simplified product development lifecycle surrounded by stages of the game-based learning strategy. This figure aligns the external environment to high-level stages of game development (the inner circle):

Stage 1: Design concept.

Stage 2: Build prototype.

Stage 3: Evaluate capabilities.

Stage 4: Manage performance.

It also suggests that game development will be iterative and become more mature over time and our understanding of the market and players will increase as we get better at building games.

This roadmap will work in sync with the life cycle. Shifting to product roadmaps promises to elevate all products to a greater level of fidelity and interchangeability thereby making it much easier to leverage content across product lines.

Each game will have product leads who are responsible for the product roadmap, versioning, market analysis, outcomes, pricing, performance, KPIs, and growth. We will become product-centric for the following reasons:

Leverage and reuse

Modularize for interoperability and impact

Anticipate and serve our customers better

Get to market faster

Enhance impact

Increase margins

To achieve these larger aims, we want to build games that are designed for fun, simplicity, accessibility, social, stickiness, and longitudinal in nature. In achieving these development criteria, we also desire to scale learners and develop a sustainable revenue model. Games can be online and multiplayer and like all learning can be modular by design. That is, in using content that is interchangeable across product lines, we will be able to readily leverage good content in many ways.

Like the future of association learning, the success of game-based learning hinges on a broad-based organization-wide commitment.

Execution steps.

Build team.

Identify game prototypes.

Finalize funding plan.

Choose partner.

Develop high-level product roadmap.

Finalize subscription model.

Build game version 1.0

Market + Data

The greatest challenge to a successful game-based learning is a clear understanding of how to identify and reach the market. Will members care? Will members engage? Will members learn?

Our main goal is to build a robust program that can be a key vehicle to scale learners and enhance revenue.

In surveying the external landscape, conducting research, and reaching out to about a half dozen gaming companies. The consensus is that sound, reliable market research is elusive. Our conclusion? The lack of serious market players, lack of games for association professionals, and the large potential market present a significant opportunity.

The gaming market is red hot and growing. There are no clear market leaders in the serious games for education space, but there are plenty of developers.

There is no independent analysis of the gaming market in associations. There is no apparent market leader. Most associations are dabblers.

Competition is, however, multi-industry with potential players coming from for-profit competitors, game developers, news/information companies.

There are few games or apps specifically in the association space. There are many developers, however.

Increasing use of social media and smartphones coupled with rising adoption of gamified models should fuel industry growth over the forecast timeframe.

To increase revenue and players we will need to reach outside of one’s current core market, successfully execute our business model, partner shrewdly, and aggressively market our games.

A key part of executing a game-based learning strategy is an aggressive go to market strategy. Game-based learning is part of a larger narrative that propels us to the forefront of innovation and helps position us for unprecedented visibility and impact.

With visibility, impact, awards, and a long-term sustainable strategy, we can use this attention to push for new revenue. The bones of the go to market strategy is this prospectus.

A successful strategy will need to reach far beyond promotion or a marketing campaign. It will need sound branding, messaging, outreach, press, and public relations.

Sound data capabilities are required of any organization claiming to be ready for the future. Data is so critical that it will be hard to compete if we rely on bad data, fragmented intelligence, hunch, or evidence-less judgment.

The clear future requires us to use data to better understand our market, our products, and our outcomes. Unfortunately, data, data practices, and data infrastructure tend not to be not an organizational strengths of most associations.

This indicates that an investment in game-based learning is truly organization-wide and/or the data component of game-based learning may need to be outsourced to a partner. This part of the game-based learning prospectus addresses data from three key perspectives:

Key performance indicators. Data collected, analyzed, and used to measure the success of game-based learning program. We will use this data to determine program success and to build a program of scale and continuous improvement.

Personalized learning. Data collected, analyzed, and used to deliver personalized learning across the lifecycle. We will use this data to understand our learners better so we can deliver “what they want, how they want, when they want it” learning.

Residual revenue. Data collected, analyzed, and used to determine the unique behaviors, learning patterns, and critical insights of clinician learners. We will sell this data to industry.

Product-led growth fuels connection. Join the product community and flip your destiny.

About the Author

James Young is founder and chief learning officer of the product community®. Jim is an engaging trainer and leading thinker in the worlds of associations, learning communities, and product development. Prior to starting the product community®, Jim served as Chief Learning Officer at both the American College of Chest Physicians and the Society of College and University Planning.

Please contact me for a conversation: james@productcommunity.us.