Summary

Associations take their competition for granted and underinvest in positioning.

This article provides an overview of association positioning in order to help achieve differentiation, relevancy, and growth.

In doing so, we will define the concept and frame its importance, address why association competition can be tricky, apply Michael Porter’s Five Forces Model to the world of associations, consider the power of differentiation, and drive home the indispensability of superior positioning.

The Product Community is a product development learning community designed specifically for associations.

Defining your Competitive Landscape

How aware are you of your competition?

Most associations compete in a specific market of fairly similar players who serve the needs of a narrow customer base.

For instance, there are a small number of associations – sometimes just one – who serve technology professionals in higher education. Likewise, a somewhat similar number of associations serve apple growers, oncology nurses, or basketball coaches.

Unscientifically – if you only count other associations – most associations probably compete in a market space of only 2-4 competitors.

Most private firms would kill to have so few competitors!

Most associations have evolved over time from small gatherings of like-minded professionals (from a particular field) to full-blown professionally-run membership associations with layered governance and complex operations.

This core like-mindedness driven by shared interest creates a strong built-in niche market. This can be a positive and a negative.

The positive of having a built-in niche is that you become one, if not the only, player who does what you do.

People will identify you as differentiated, unique, and the only place to meet like-minded professionals or get access to unique products or services.

According to Jonathan Stark, a niche is a specialized corner of the market; he refers to “niching down” as moving from a general target market (e.g., “businesses”, “people”) to a more specific target market (e.g., pediatricians, environmentalists, research scientists, etc).

The problem with a niche based on a particular profession or shared interest is that the market is, or can become, finite.

It’s only as big as the number of people willing to engage in a particular space thereby making it hard to grow and evolve as an organization or a movement.

Does your association rely on growth to make an impact? How do you identify and reach new markets? What specific steps do you need to take to become and remain relevant? What is your plan to scale?

As you become known for a particular niche there may be an unintended consequence of making it difficult to identify and reach new markets.

A competitive analysis can help you learn what your competition does, how they work, and who they serve. It can also help you identify possible areas for your association to outperform them.

A competitive analysis also enables your association to stay atop of trends and ensure your offerings are consistently meeting and exceeding industry standards.

Here are some benefits of conducting a regular competitive analysis:

Helps identify (and keep fresh) your association’s unique value proposition

Helps determine the distinctiveness of your association’s offerings

Helps you learn about your competition’s unique selling points or differentiators

Helps identify new markets or possible areas of opportunity

Provides you with a usable benchmark to help gauge your association’s positioning.

Next we’ll dig deeper into the uniqueness of associations and how this poses challenges when conducting a competitive analysis.

The Uniqueness of Association Competition

"Don't knock your competitors. By boosting others you will boost yourself. A little competition is a good thing and severe competition is a blessing. Thank God for competition."

Jacob Kindleberger

When was the last time your association did a competitive analysis?

What did you learn?

Did you gain deep insights about your competitors?

Did the insights inform your strategy and help you differentiate and succeed?

Often, an association competitive analysis starts and ends with a review of other association websites and/or social media presence.

As associations tend to be a cooperative industry, the executive directors of similar associations may have existing relationships whereby they can gain a little insight.

A competitive analysis helps you identify major competitors and research their unique value proposition, markets served, offerings, and marketing strategies.

Given the importance of staying ahead of the pack, most association competitive analyses are based on little more than guesswork.

However, when trying to analyze your association’s competition we should keep the following in mind:

Apples and oranges. Direct comparisons with other associations are imprecise and hard to measure. Competition is based more on your association’s unique mission, capability, or strength of member interest.

Associations collaborate. Unless they are truly comprehensive (and don’t have a need to collaborate), associations regularly and openly (but not always) work together.

New competition. There is a new competitive landscape for associations. We no longer own a particular space. Members can satisfy their needs in lots of ways. Instead of just being aware of the other associations in our tangent space (or brand neighborhood), we need to know where our members go for professional networking, new content, and experiences to guide them on their professional journey. Our new competitive landscape includes things as broad as the internet, private firms that offer professional development, or online communities.

Market size. When erring on the side of caution, we should favor fewer competitors (typical of most associations) and more market prospects (prospective members or new markets), primarily because there are other ways to differentiate our expertise that aren’t as fatal if we get them wrong, like process, pricing, and IP.

Some things to focus on as you frame your competition:

Focus on problems not people. It may seem counterintuitive to not focus on people (members) for associations that serve a particular industry or profession – whether it’s psychologists, morticians, university presidents, or engineers. However, by identifying compelling shared problems and moonshot goals gives your association something to rally around and allow you plenty of opportunities to draw new people. As the world becomes more messy, complex, and uncertain, interdisciplinary solutions are needed suggesting that entre to new markets can be gained by drawing new perspectives.

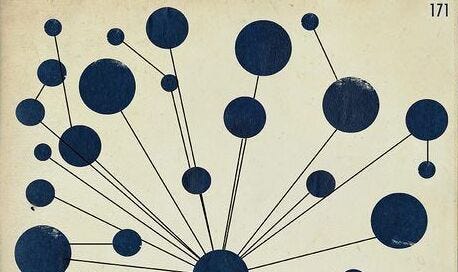

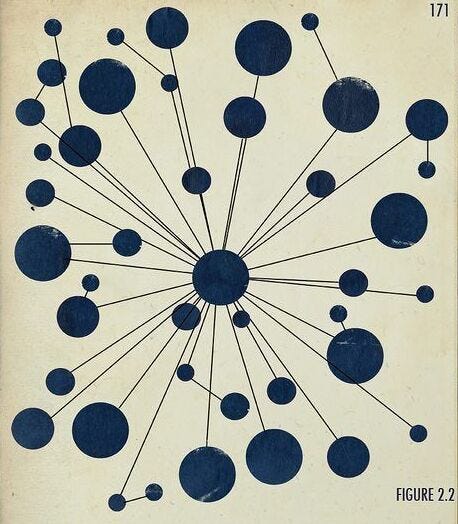

Opportunity + courage. Referring to the below diagram from David C. Baker’s excellent book The Business of Expertise: How Entrepreneurial Experts Convert Insight to Impact + Wealth, moving your association from the right (undifferentiated) to left (differentiated) on the below diagram takes an investment in something most associations ignore: positioning. As you work out the intricacies of the positioning journey, there are two forces that slow your progress: lack of sufficient opportunity (number of new people in your core target market) and lack of courage (willingness to reach new markets with a focused niche).

Exploit your niche. The goal of most associations is to be distinctive and, therefore, less interchangeable with other associations. This is somewhat of a paradox. A more focused niche suggests a smaller market, when in fact becoming known for something and focusing like a laser on a specified area of impact is how growth happens. The opposite is also true: if you’re all things to all people, it’s harder to achieve distinctiveness. You lack a compelling value proposition and look like everyone else. It’s hard to move the needle on anything meaningful.

Draw the youth market with a fresh value proposition. All associations desire to more fully engage the youth market (ages 20 to 35) yet still operate on an old business model (membership + event-centric) that continues to draw people in their forties, fifties, and sixties. Fortunately, the youth market is interested in shared purpose and new ways of engaging. What is the best way to build on this inherent energy?

Invest in thought leadership. Through proprietary thought leadership you can build authority and help your association stand apart from competitors. In the process, you can also create efficiencies and result in successful outcomes.

Track your comparators and aspirants. We recommend building and maintaining a list of comparator and aspirant associations so you can properly benchmark the outcomes of your distinctiveness.

Knowing your competition can help you develop a differentiated strategy, thereby helping to frame your business model or offerings more defensible.

A competitive analysis can also help you more deeply understand your members. Done the right way, a competitive analysis can help your association achieve a truly competitive advantage.

Let’s look at Michael Porter’s classic Five Forces Model to analyze how associations might analyze their competition and gain a foothold on superior positioning.

Michael Porter’s Five Forces Model

"The ability to learn faster than your competitors may be the only sustainable competitive advantage."

Arie de Geus

There are many ways to conduct a competitive analysis. Like we suggest above, association markets are different from nearly any market. Our job is not just to identify competitors, it is to dig deep and understand nuances so we can gain insights to help define our strategy and achieve superior positioning in the market.

Michael Porter’s Five Forces Model is one tool worth using. In Porter’s model, the five forces that shape industry competition are:

Competitive rivalry. This force examines the intensity of market competition by considering the number of association competitors. Rivalry is high when there are a few associations with similar offerings; this way members can easily switch to a competitor association for little cost. When rivalry is high, pricing wars can ensue, which can hurt an association's bottom line. Keep in mind: a generation of non-joiners who may not see the value in joining an association could affect your analysis.

Bargaining power of suppliers. This force analyzes the power association suppliers – partners, sponsors, service providers, etc. – have and how much control they have over raising prices, which, in turn, can lower an association’s profitability. It also assesses the number of suppliers available. The fewer suppliers, the more power they have. Associations are in a better position when there are multiple suppliers. Keep in mind: It makes sense to outsource when prices are low and there are many suppliers to choose from.

Bargaining power of members. This force examines the power of the member, and their effect on pricing and quality. Members have power when they are fewer in number but there are plentiful associations (or companies) for members to switch. Conversely, buying power is low when members purchase products in small amounts and the association’s product is very different from that of its competitors. Keep in mind: Differentiating your identity, mission, vision, and offerings reduces the bargaining power of prospective members.

Threat of new entrants. This force considers how easy or difficult it is for competitors to join the marketplace. The easier it is for a new competitor to gain entry, the greater the risk is of an established association’s market share being depleted. Barriers to entry include size of market, access to subject matter experts, economies of scale, and strong brand identity. Keep in mind: The trick with association competition is the threat of

Threat of substitutes. This force studies the ease of members to switch from an association's product to that of a competitor. It examines the number of competitors and how their prices and quality compare, and how much of a profit those competitors are earning (which would determine if they can lower their costs even more). Keep in mind: building hard-to-copy association products can reduce the ability for rivals to understand or replicate your strategy. It’s important to remember that non-association competition (private companies, open access orgs, or freely available professional networking sites) may have compelling substitutes rendering your competitive advantage mute.

All associations need to ensure they are analyzing the right competition. That is, competition may not just be other associations. The Business Model Canvas (BMC) and Jobs-to-be-Done Theory (JTBD) can help plug both these gaps and provide a holistic understanding of the right competition for your association.

We will cover both the BMC and JTBD in future posts. Here is a quick excerpt from Tony Ulwick’s article Jobs-to-be-Done: A Framework for Customer Needs.

Armed with knowledge of all the customers’ needs, a product team can:

Determine which needs are unmet

Discover segments of customers with unique sets of unmet needs

Systematically conceptualize breakthrough products

Predict which new concepts and offerings will win in the marketplace

Align the actions of marketing, development, and R&D to orchestrate the systematic creation of customer value

We end this article with a strong pitch for investing in ongoing competitive analysis and the centrality of defining and refining your positioning to gain defensible and superior competitive advantage in the market.

Positioning Your Association for Growth

"Link to your competitors and say nice things about them. Remember, you're part of an industry."

Robert Scoble

In our recent article on Go To Market (GTM) we discussed the concept of value proposition. Here we want to reinforce the importance of using a value proposition to drive differentiation.

Creating a unique, airtight value proposition helps to position your association for distinctiveness, success, and growth.

Associations commonly fall into the trap of thinking that growth can be achieved by broadening your mission, developing a mushy vision, or becoming all things to all people.

Nothing could be further from the truth!

Growth comes from investment in strategy (not the same thing as a strategic plan). A great strategy happens when this investment results in making shrewd choices, integrating these choices wisely, and sticking to these choices in a way that sharpens and deepens your value proposition.

Growth in associations is directly linked to focused value. It’s how your members will feel connected and engaged and willing to pay for the value your association delivers.

As you embark on your journey to understand your competition, remember that positioning is king. Competing in a new association market space doesn’t mean creating a monopoly or crushing your competition.

It means delivering superior value.

Some competition is healthy, so aim for a few competitors to position your association’s expertise and authority to support a focused value proposition and, ultimately, deeper connection and superior return for the value you develop and deliver.

Remember, product-led growth fuels connection. Join the product community and flip your destiny.

About the Author

James Young is founder and chief learning officer of the product community®. Jim is an engaging trainer and leading thinker in the worlds of associations, learning communities, and product development. Prior to starting the product community®, Jim served as Chief Learning Officer at both the American College of Chest Physicians and the Society of College and University Planning.

Please contact me for a conversation: james@productcommunity.us.